Sierra Chart Absorption Detector

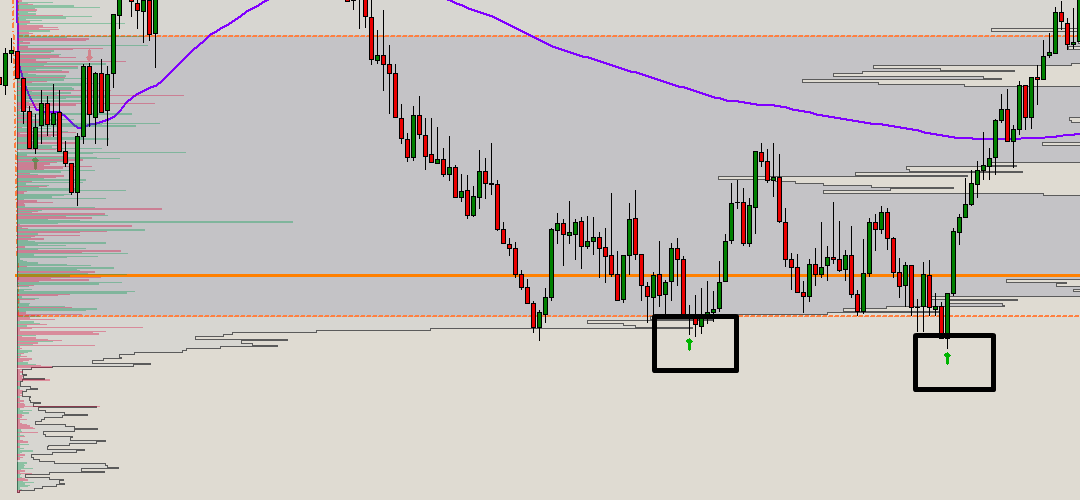

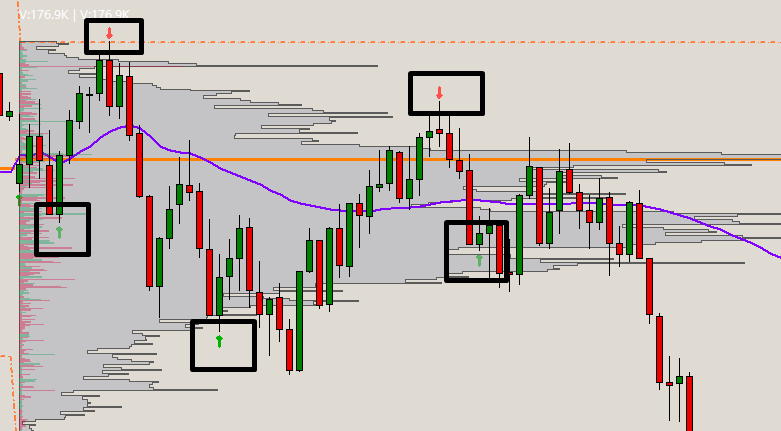

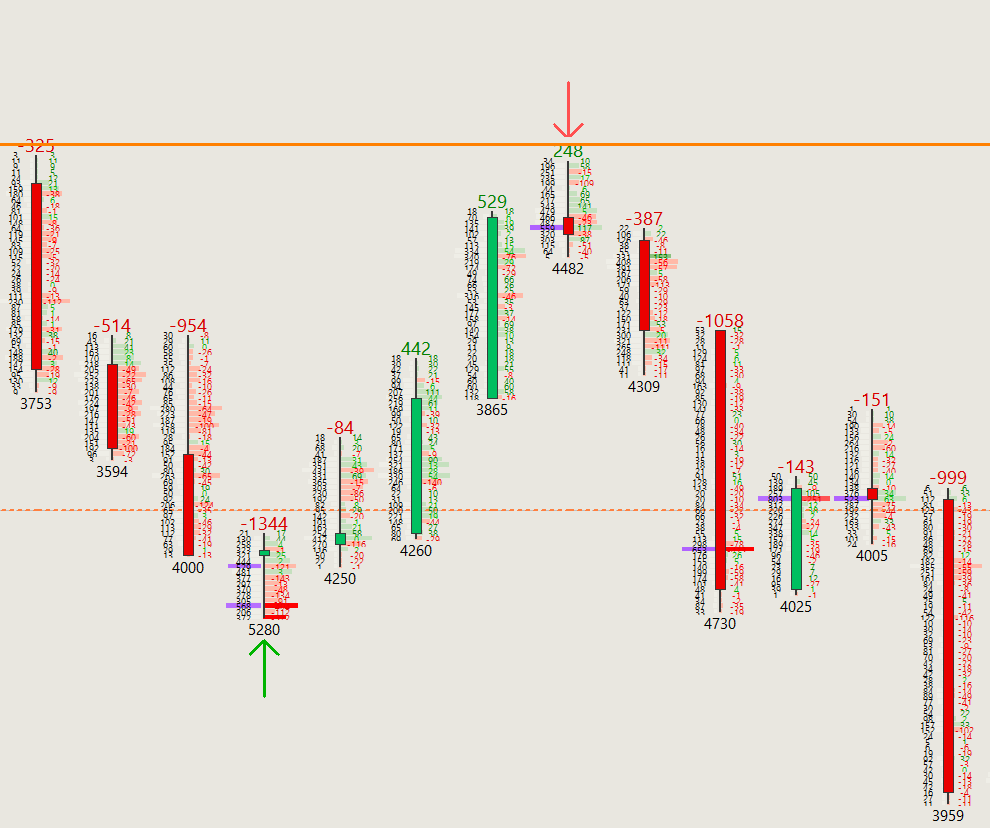

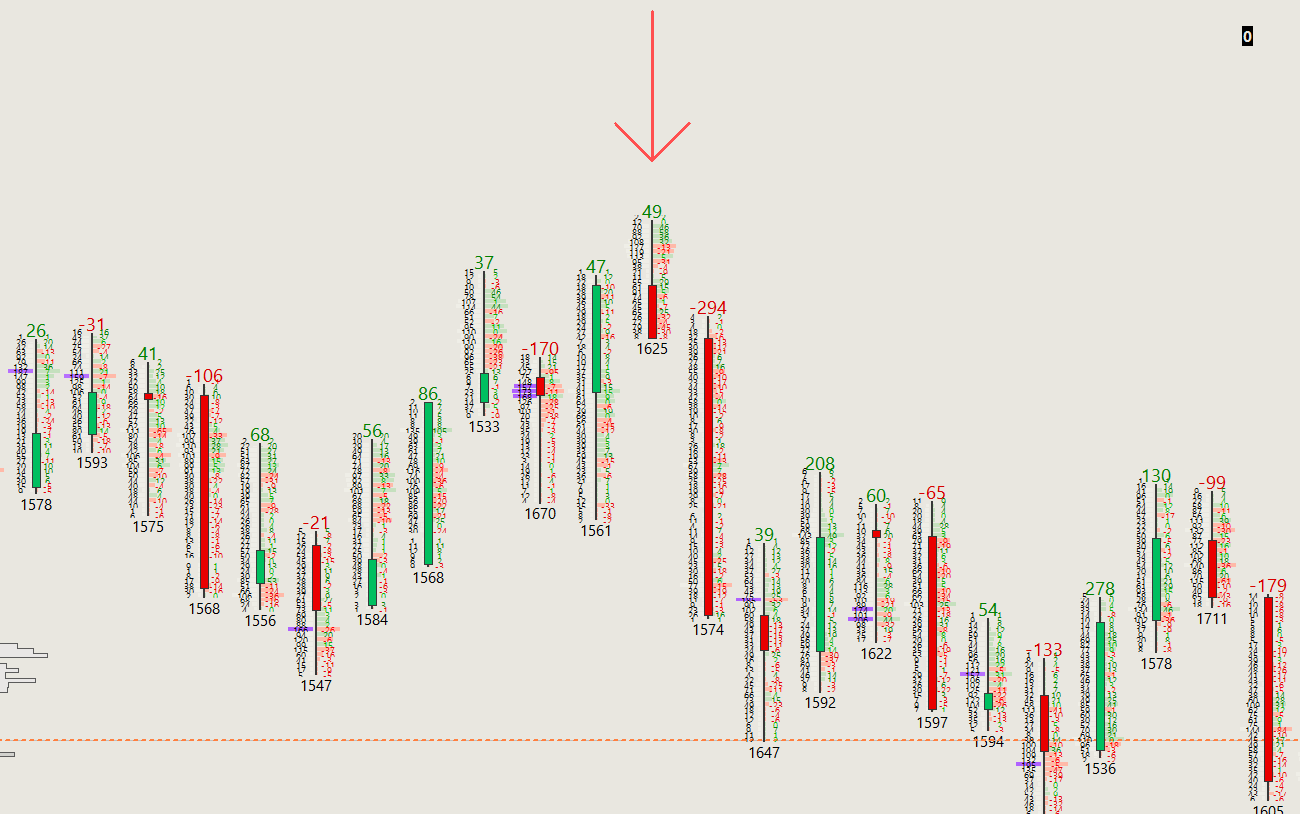

The Absorption Detector is a powerful custom study designed to spot potential reversals in futures markets using footprint and order flow analysis.

It identifies high-volume price levels where aggressive buying or selling gets "absorbed," signaling trapped traders and high-probability turns.

Optimized for ES and NQ, but customizable for other markets like GC (Gold) by adjusting volume thresholds. This bundle includes two versions: one tuned for ES and one for NQ, with pre-set defaults for immediate use. But you can modify the settings for more or less signals depending on the market environment and adjust to your own trading style and instruments. All you have to do is add them to any lower timeframe chart including footprint.

I personally use ES on a 3000 tick chart and NQ on a 1500 tick chart with their respective footprint charts, but these indicators can be applied to time based intervals as well, like a 1 or 5 minute chart. You might need to adjust the thresholds to compensate for volume differences.

Includes all future updates and an in depth video guide explaining how to install the .dll study files in your system and what each setting does.

Available for Windows, Intel Macs, and Apple Silicon Macs!

*Please note that you will need an advanced package on Sierra Chart to get full market depth with bid/ask data for the indicator to work. I recommend and use Advanced Package 11 with the included Denali data.

Features:

Footprint-Focused Reversal Signals: Detects absorption at extremes with per-price-level volume checks — no total bar volume required.

Market-Specific Presets: ES and NQ versions with tailored volume signal thresholds for both extended (6pm-9:30am EST) and regular (9:30am-4pm EST) trading hours. No matter what time of the day you can trade, the volumes can be tailored to suit the current market volatility.

Customizable Filters: Toggle options for high-volumes near extreme (with adjustable percentage), delta divergence, cumulative delta divergence, and volume spike detection.

Arrow Visuals: Clean, scalable arrows with head size, overall size multiplier, and vertical offset for perfect chart fit.

Hide Drawings Toggle: Quickly hide all arrows and text without removing the study.

Compatible with Any Futures Market: Preset for ES & NQ but can be used on GC, CL, or other symbols by adjusting volume thresholds to match liquidity.

No Audio Alerts: Silent by default for distraction-free trading.

Access to in Depth Video Installation & Settings guide.

Mac Users:

If your Mac has an Apple Silicon chip (M1, M2, M3, M4 — check Apple menu → About This Mac → Chip): use the _ARM64.dll files

If your Mac has an Intel chip: use the standard _64.dll files (they run x64 natively via Rosetta)

All Windows users use the standard _64.dll versions

Installation Instructions:

1- After purchase, email your Sierra Chart Account Name to priceactionvolumetrader (at) gmail.com. This is mandatory as you need to be manually added into the authorized user list for the indicators to work. Also include what operating system you have (Windows, Intel MAC, Silicon MAC) to authorize you in the correct system. Please use “Custom Sierra Chart Indicator” on the subject line for easier identification.

2- You’ll receive an email with general information, the download link for the custom ES and NQ preset .dll files and the video guide within 24 hours.

3- Copy the files into your Sierra Chart data folder. By default it will be at: C:\SierraChart\Data.

4- Add the indicators to your chart by going to Analysis → Studies → Add Custom Study.

5- Select the DLL files from the list (PAVT_AbsorptionDetector_ES & PAVT_AbsorptionDetector_NQ) and click Apply. They are both the same base file, just with different presets for each market.

6- The studies will show on your charts and the indicator list on the right. To customize them double click on it or mark and click on settings.

7- Watch the complete video guide link sent by email.

FAQ Section

What markets is this for? Optimized for ES and NQ futures, but customizable for others like GC (Gold) by adjusting volume thresholds to match the instrument's liquidity.

How does it work? It scans footprint bars for high-volume price levels with optional filters for extremes, delta divergence, and volume spikes to spot absorption/trapped traders.

What timeframe should I use? Best on tick charts (I use ES on 3000 tick and NQ on 1500 tick). On Sierra Chart these are called “Number of Trades” under the Bar Period Chart Settings. But can be used on different tick numbers or minute based bars with adjusted thresholds.

Does it require a specific data feed? Works with any bid/ask volume feed. I use and recommend Package 11 on Sierra Chart with Denali feed for accuracy. This is what I use to trade both live futures accounts as well as Prop Firms with Rithmic data connections.

Can I customize it? Yes — all settings (thresholds, filters, arrow visuals) are adjustable in the Study Settings window.

How do I get authorized? Email your Sierra Chart Account Name after purchase & operating system — you'll be added within 24 hours. You can use the website contact form or write directly to priceactionvolumetrader (at) gmail.com.

What if I cancel my subscription? Access ends at the end of the billing period — arrows/signals stop appearing, but your chartbook remains intact.

Is there a free trial? Not at the moment.

Do you offer support? Yes — email support for any issues.

Terms of Use & Risk Disclaimer

This indicator is for personal, non-commercial use only. Do not redistribute, resell, or share the DLL files. These files are protected and cannot be accessed without explicit permission granted by the owner on the Sierra Chart dashboard.

Subscription is monthly recurring via Stripe — cancel anytime through your Stripe account.

Past performance is not indicative of future results. The Absorption Detector is a tool for informational purposes only and should not be used blindly without other market context, risk management, or personal judgment. Trading futures involves substantial risk of loss and is not suitable for all individuals.

No guarantees or warranties are provided. Results may vary based on market conditions, timeframe, and settings.

We reserve the right to update or modify the indicator at any time. Updates are included with active subscriptions.

By purchasing, you agree to these terms.

Refund Policy

No refunds are available on digital goods after access is granted (DLL files delivered and authorization added). Please contact us before purchase if you have questions.

If you experience technical issues, we'll work with you to resolve them, including support via email.